The Smart Money Concept (SMC) refers to the idea that institutional investors—such as banks, hedge funds, and professional traders—hold significant power in the financial markets, including forex. These entities, collectively known as “smart money,” have access to larger capital, better resources, and more sophisticated trading strategies compared to retail traders. The goal of using SMC in forex trading is to follow the moves of these big players and capitalize on their trades, giving you a strategic edge in the market.

What is Smart Money Concept (SMC)?

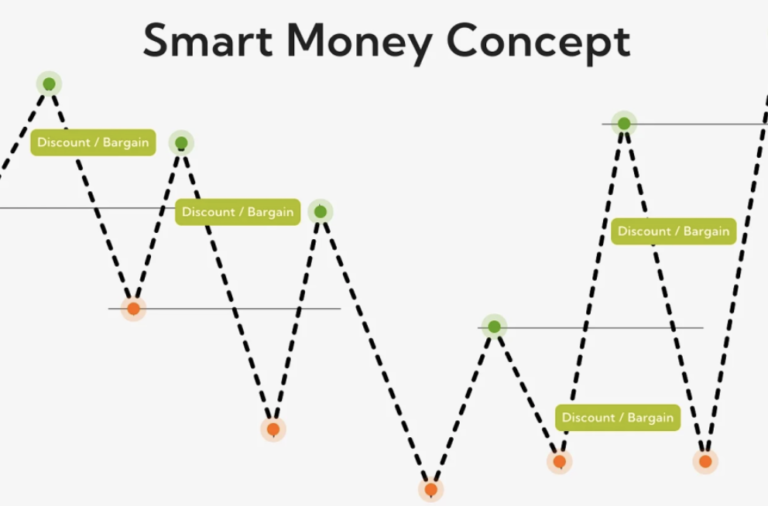

At its core, the Smart Money Concept is about understanding how institutional traders operate and how they manipulate market prices to accumulate positions. Unlike retail traders, who often react emotionally to market movements, institutional traders focus on long-term trends and accumulate positions strategically. This often involves manipulating price action to create liquidity zones, which trap retail traders into making impulsive trades, allowing the smart money to enter the market at favorable prices.

Key Components of the Smart Money Concept

To use the Smart Money Concept effectively in forex trading, it’s essential to understand a few key principles:

1. Liquidity Zones

Institutional traders often target areas of liquidity, where there is a high volume of orders. These zones can be areas of support and resistance, as well as psychological price levels. Retail traders tend to place stop-loss orders around these levels, and institutional traders aim to push the price toward these zones to trigger those stop losses, creating opportunities for them to enter or exit the market.

2. Order Blocks

Order blocks are areas on the chart where large orders are placed by institutional traders. These blocks are typically found near key support and resistance levels. By identifying these areas, retail traders can anticipate where the smart money is likely to enter the market and position themselves accordingly.

3. Market Manipulation

Institutional traders have the resources to manipulate market prices to their advantage. This often involves pushing the price in a certain direction to create liquidity, only to reverse the move later. For example, institutional traders may push the price higher to trigger buy orders from retail traders, only to reverse the trend and take those buy orders out of the market. Recognizing this manipulation can help you avoid common retail trading traps.

How to Use Smart Money Concept in Forex Trading

Now that you understand the basics of the Smart Money Concept, here are several strategies you can use to follow the smart money in forex trading:

1. Identify Liquidity Pools

One of the primary strategies in SMC is to locate liquidity pools—areas where there are a large number of stop-loss orders placed by retail traders. These pools are typically found near support and resistance levels. Once identified, you can anticipate that institutional traders will push the price toward these zones to trigger stop-losses, providing them with liquidity to enter the market. By waiting for these moves, you can enter trades at more favorable prices.

2. Look for Order Blocks

Order blocks are a critical component of SMC. These are areas on the chart where institutional traders place large orders, causing the price to react. By identifying order blocks, you can predict future price movements, as institutional traders are likely to defend these levels. For instance, if the price revisits a previous order block, it may provide a good opportunity to enter a trade in the same direction as the smart money.

3. Understand Market Structure Shifts

Market structure shifts occur when the price breaks a key support or resistance level, signaling that institutional traders may be changing their positions. A shift in market structure can indicate the start of a new trend or the end of a current one. By recognizing these shifts, you can position yourself to take advantage of the smart money’s moves.

4. Avoid Retail Trading Traps

Retail traders often fall into predictable patterns, such as entering trades based on short-term trends or emotional reactions to price movements. Institutional traders know this and use it to their advantage. By focusing on the long-term market structure and following the smart money, you can avoid these common traps and enter the market at more opportune times.

Benefits of Using the Smart Money Concept in Forex Trading

Trading based on the Smart Money Concept offers several advantages over traditional retail trading approaches:

1. Better Market Understanding

By understanding how institutional traders operate, you gain a deeper insight into market dynamics. This allows you to make more informed decisions and anticipate market moves with greater accuracy.

2. Higher Probability Trades

Following the smart money means aligning your trades with the most powerful players in the market. This increases the likelihood of success, as institutional traders tend to have a more accurate view of market conditions and trends.

3. Reduced Risk of Stop-Hunts

Stop-hunts occur when institutional traders push the price toward retail traders’ stop-loss orders to create liquidity. By recognizing the smart money’s strategy, you can avoid placing your stops in obvious areas and reduce the risk of being stopped out unnecessarily.

Conclusion

The Smart Money Concept is a powerful tool for forex traders who want to follow the moves of institutional investors and improve their chances of success. By understanding liquidity zones, order blocks, and market structure shifts, you can align your trading strategy with the smart money and avoid common pitfalls that trap retail traders. Whether you’re a beginner or an experienced trader, incorporating SMC into your trading plan can give you a competitive edge in the forex market.

Sangat membantu