The Bearish Engulfing pattern plays a critical role in forex trading as a strong signal for potential market reversals from an uptrend to a downtrend. This pattern helps traders identify when a trend is likely losing momentum, allowing them to make strategic decisions about entry and exit points, manage risk, and maximize profits.

What is the Purpose of the Bearish Engulfing Pattern?

The main purpose of the Bearish Engulfing pattern is to alert traders to a potential reversal, signaling that a prevailing uptrend may be coming to an end. The pattern highlights that sellers are beginning to take control of the market, often after buyers have been pushing prices upward. Recognizing this pattern helps traders anticipate a possible trend change and adjust their strategies accordingly.

Key Functions of the Bearish Engulfing Pattern

- Identifying Reversal Points: The Bearish Engulfing pattern is a reliable indicator that the current uptrend is potentially reversing. By recognizing this, traders can make timely decisions to enter short positions (sell) or exit long positions (buy).

- Risk Management: When the Bearish Engulfing pattern appears, traders can set stop-loss levels above the pattern to protect against significant losses. This pattern allows them to manage risk more effectively by confirming when to limit exposure in a weakening uptrend.

- Profit Optimization: The Bearish Engulfing pattern also aids traders in maximizing profits by helping them catch potential price reversals early. Traders can place short trades with the expectation of capturing downward price movement and securing higher returns.

How to Apply the Bearish Engulfing Pattern Effectively

To fully leverage the Bearish Engulfing pattern, traders should look for the following factors that confirm the pattern’s reliability:

- Confirming Market Conditions: Check for additional signs of reversal, such as a price break below support levels, increased volume during the bearish candle formation, or signals from other indicators like MACD or RSI.

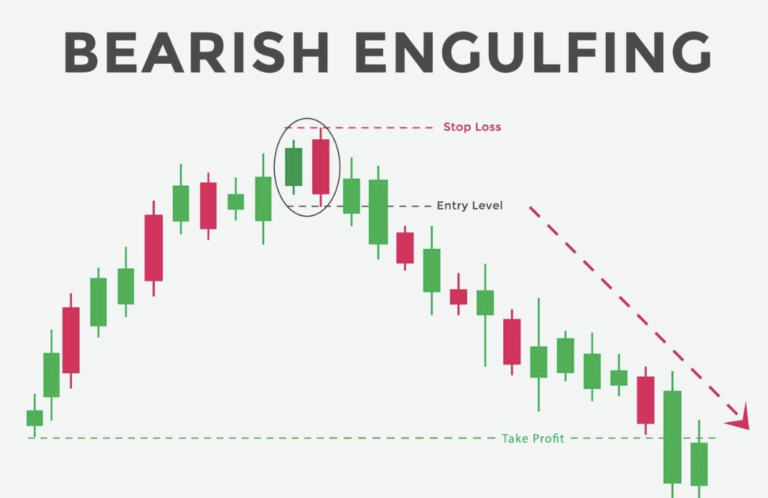

- Entry Points: When confirmed, enter a short position by placing an order slightly below the engulfing candle’s low. This positioning captures the downward momentum initiated by the bearish reversal.

- Setting Stop-Loss Levels: Protect against market fluctuations by placing a stop-loss above the high of the engulfing candle. This ensures minimal risk in case of a false breakout or retracement.

Conclusion

The Bearish Engulfing pattern is a valuable tool in forex trading, providing critical insight into potential reversals and allowing traders to optimize risk management and profit-taking. By understanding and effectively utilizing this pattern, traders can make well-informed decisions and enhance their trading performance. Incorporating the Bearish Engulfing pattern as part of a broader technical strategy is a prudent approach for any trader looking to navigate volatile forex markets.