Support and resistance levels are essential tools in technical analysis, helping traders identify price zones where the market is likely to reverse or consolidate. By leveraging these levels effectively, you can develop a low-risk, high-reward trading strategy. This guide will explain how to use support and resistance levels to maximize potential profits while minimizing risk.

Understanding Support and Resistance

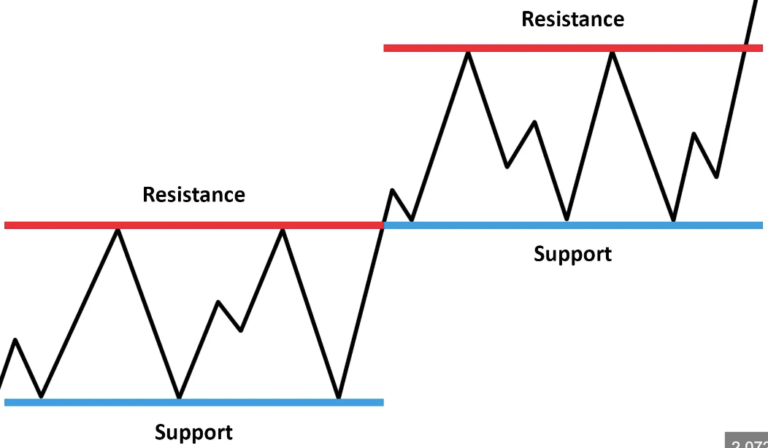

Support and resistance levels are price zones where the market shows significant buying or selling activity:

- Support: A price level where demand is strong enough to prevent the price from falling further. It acts as a floor for the market.

- Resistance: A price level where selling pressure prevents the price from rising higher. It acts as a ceiling for the market.

Key Steps to Implement the Strategy

Follow these steps to develop a trading strategy using support and resistance levels:

1. Identify Key Levels

Analyze historical price charts to locate areas where prices have previously reversed or consolidated. These areas are likely to serve as strong support or resistance zones in the future. Use tools like horizontal lines or Fibonacci retracements to mark these levels.

2. Confirm Levels with Price Action

Validate support and resistance levels by observing price action. Look for:

- Multiple touches of the level without breaking.

- Rejection patterns like pin bars or engulfing candles near these zones.

3. Set Entry Points

Plan your trades around these key levels:

- Buy near support: Enter long positions when the price approaches and shows signs of bouncing off a support level.

- Sell near resistance: Enter short positions when the price approaches and shows rejection at a resistance level.

4. Use Tight Stop Losses

Place stop-loss orders slightly below support or above resistance to limit potential losses if the price breaks through the level. This approach ensures that your risk remains minimal.

5. Aim for High Reward Targets

Set profit targets at the next major support or resistance level. The distance between your entry and target should be significantly larger than the distance to your stop-loss, ensuring a favorable risk-reward ratio.

6. Monitor and Adjust

Continuously monitor price action and adjust your levels or positions as necessary. Breakouts, retests, and market conditions can change the relevance of support and resistance zones.

Advantages of This Strategy

This strategy offers several benefits:

- Low Risk: Tight stop-loss levels limit the downside potential.

- High Reward: Targeting larger price movements ensures a favorable risk-reward ratio.

- Clear Entry and Exit Points: Support and resistance levels provide logical zones for decision-making.

Common Mistakes to Avoid

When using this strategy, avoid these pitfalls:

- Ignoring False Breakouts: Validate breakouts with volume or additional confirmation before acting.

- Overlooking Market Context: Consider the overall trend and economic factors influencing price action.

- Risking Too Much: Stick to strict risk management rules to protect your capital.

Conclusion

Support and resistance levels form the foundation of many successful trading strategies. By combining these levels with tight risk controls and a disciplined approach, you can create a low-risk, high-reward strategy that helps you capitalize on market opportunities. Remember, patience and practice are key to mastering this method.