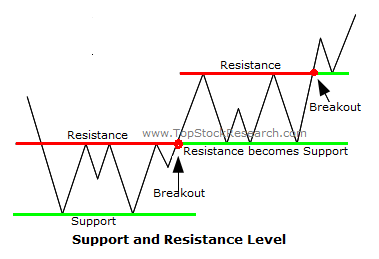

In forex trading, understanding key concepts like Support Become Resistance (SBR) can significantly improve your trading decisions. SBR happens when a level that previously acted as support—holding the price from falling lower—turns into a resistance level after being broken. This shift is an important indicator of market sentiment and trend direction. Let’s dive deeper into what SBR means, how it works, and how you can use it effectively in your trading strategy.

What is Support?

Support in forex refers to a price level where a currency pair tends to find buying interest and stops from falling further. It acts like a floor where demand increases as the price drops, causing the price to bounce back up. Traders look for support levels to identify potential entry points for buy positions.

What is Resistance?

Resistance is the opposite of support. It’s a price level where selling interest increases as the price rises, preventing the price from going higher. It acts like a ceiling that caps the upward movement. Traders use resistance levels to find potential exit points or to enter sell positions when expecting a price drop.

What Does Support Become Resistance (SBR) Mean?

When a support level is broken, it often turns into a resistance level. This is known as Support Become Resistance (SBR). It happens because once the support level is breached, the buying pressure that was previously holding the price up disappears, and sellers start entering the market at that level, causing it to now act as resistance.

Why Does SBR Happen?

In the case of SBR, the psychology of market participants plays a big role. Buyers who initially bought at the support level might want to sell at the same level after it is broken, causing a shift in supply and demand dynamics. This new selling pressure at the old support level creates resistance as traders seek to exit losing positions or short the market.

Example of Support Become Resistance (SBR)

Let’s look at a practical example:

- A forex pair, such as EUR/USD, finds support at the 1.2000 level. Every time the price drops to this point, buyers step in and push the price higher.

- Eventually, the price breaks below the 1.2000 level and drops to 1.1900.

- Now, when the price tries to rally back up to 1.2000, it faces resistance at this level because traders who bought at 1.2000 before now look to sell. This is the SBR concept in action.

How to Trade Using SBR

Understanding and applying the SBR concept can help traders identify key entry and exit points. Here’s how you can trade using SBR:

- Identify Key Levels: First, identify important support and resistance levels on your chart using technical tools like horizontal lines or Fibonacci retracement levels.

- Wait for a Break: Monitor the market to see if the support level is broken. A break of a support level signals that SBR might come into play.

- Look for a Retest: After the price breaks below support, wait for the price to retest the old support level, which should now act as resistance.

- Confirm the Reversal: Use other indicators such as candlestick patterns or oscillators (like RSI) to confirm that the old support is now acting as resistance.

- Enter the Trade: Once confirmed, enter a short trade (sell) with a stop-loss placed slightly above the new resistance level.

Why SBR is Important for Traders

Traders rely on SBR for several reasons:

- Clear Trend Reversals: SBR helps identify potential reversals in market trends. When support turns into resistance, it often indicates that an upward trend is shifting into a downward trend.

- Accurate Entry Points: SBR provides an opportunity to enter the market at a low-risk, high-reward point when the price retests the broken support.

- Improved Risk Management: By placing stop-loss orders above newly formed resistance levels, traders can better manage their risk.

Common Mistakes When Trading SBR

While SBR is a powerful concept, there are some common mistakes traders make:

- Entering Too Early: It’s crucial to wait for a proper retest and confirmation before entering a trade. Entering too early can lead to false breakouts.

- Ignoring Other Indicators: Don’t rely solely on SBR. Combine it with other technical indicators like moving averages, oscillators, or chart patterns to increase accuracy.

Conclusion

In conclusion, Support Become Resistance (SBR) is a fundamental concept in forex trading that helps traders understand key market dynamics. By recognizing when a support level turns into resistance, traders can better predict potential reversals and improve their trading strategy. Applying SBR correctly in your trades can lead to more profitable opportunities and better risk management in the forex market.