In the world of forex trading, understanding market dynamics is key to making successful trades. One of the most useful concepts that traders rely on is the Support Become Resistance (SBR) pattern. This pattern can help traders understand market shifts and identify new opportunities. But what exactly is the function of SBR in forex trading? Let’s explore this concept in detail.

What is SBR?

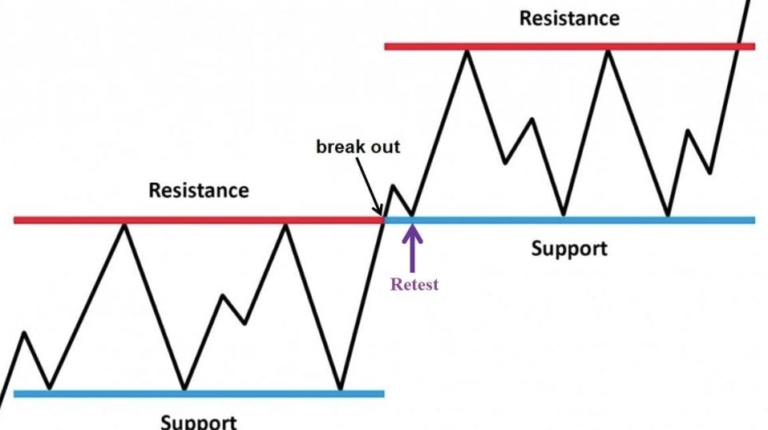

First, let’s define what Support Become Resistance (SBR) means. SBR occurs when a price level that previously acted as support—preventing the price from dropping further—breaks down and transforms into a resistance level. This means that after the support level is breached, it starts to act as a ceiling, preventing the price from rising back up.

The Role of Support in Trading

Support is a price level where demand is strong enough to stop the price from falling. It acts as a floor, where buyers come in to push the price higher. Support levels are key points in the market where traders look to enter buy trades, anticipating a price bounce.

The Role of Resistance in Trading

Resistance, on the other hand, is the opposite of support. It is a level where selling interest is strong enough to prevent the price from rising further. This acts as a ceiling, stopping upward movements. Traders look to enter sell trades at resistance points, expecting the price to drop.

How SBR Functions in Forex Trading

When the support level is broken, it often turns into a resistance level. This transformation is significant in technical analysis because it indicates a shift in market sentiment. Here are the key functions of SBR:

- Identifying Trend Reversals: One of the main functions of SBR is to help traders spot potential reversals in market trends. When a support level is breached and becomes resistance, it can signal that an upward trend is coming to an end, and a downward trend is beginning.

- Providing Key Entry Points: Traders often wait for the price to retest the new resistance level (formerly support) to enter sell trades. This allows them to enter the market at a point where the price is likely to face resistance again, maximizing their profit potential.

- Improving Risk Management: By placing stop-loss orders above the new resistance level, traders can manage their risk more effectively. Since the price is less likely to break through the resistance level, stop-loss orders are better positioned, reducing the chance of unnecessary losses.

Example of SBR in Action

Let’s consider an example to better understand how SBR functions:

- Imagine that a currency pair like EUR/USD has found support at the 1.1500 level. Every time the price falls to this level, buyers step in, pushing the price higher.

- Eventually, the price breaks through the 1.1500 level and continues to fall. At this point, the old support level becomes resistance.

- Now, as the price attempts to rally back to 1.1500, it faces resistance because traders who bought at this level earlier are now looking to sell. This is where SBR comes into play.

Using SBR to Predict Market Movements

The SBR pattern can be extremely useful in predicting future price movements. After a support level turns into resistance, traders can expect that the price will have a harder time breaking back above that level. This insight allows traders to anticipate future selling opportunities at the new resistance level.

Advantages of Using SBR

Here are some advantages of incorporating the SBR concept into your trading strategy:

- Clearer Market Signals: SBR gives traders clearer signals about when a market is reversing its direction. By recognizing these changes, traders can adjust their strategies accordingly.

- Better Timing for Entries and Exits: SBR helps traders time their trades more effectively. Instead of entering too early or too late, the retest of the new resistance level offers a strong entry or exit point.

- Reduced Risk: With SBR, traders can place stop-loss orders at logical levels, improving their risk management and minimizing losses.

Common Pitfalls When Using SBR

Although SBR is a useful tool, there are some common pitfalls to avoid:

- Entering Trades Prematurely: Always wait for confirmation that the old support has truly become resistance before entering a trade.

- Ignoring Other Indicators: Don’t rely solely on SBR. Combine it with other technical indicators for more accurate predictions.

- Misjudging Market Conditions: SBR works best in trending markets. It may not be as effective in ranging or sideways markets.

Conclusion

In conclusion, the Support Become Resistance (SBR) concept is a vital part of technical analysis in forex trading. It helps traders identify key turning points in the market and provides reliable entry and exit points for trades. By understanding how SBR functions, traders can enhance their strategies, reduce risk, and ultimately make more informed trading decisions. Whether you’re a beginner or an experienced trader, mastering the SBR concept can significantly improve your chances of success in the forex market.

Very helpful blog post