In forex trading, the Morning Star is a powerful candlestick pattern that signals a potential reversal from a downtrend to an uptrend. Recognized for its accuracy, this pattern is commonly used by traders to identify when buying pressure may start outweighing selling pressure, suggesting an opportunity to enter long (buy) positions.

What is the Morning Star Candlestick Pattern?

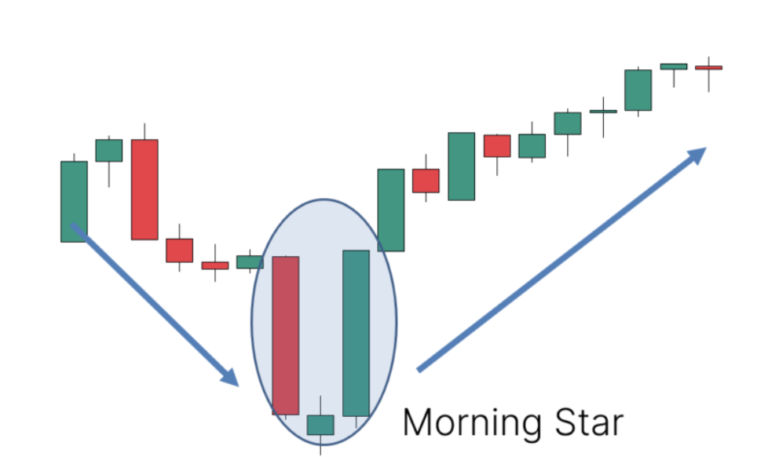

The Morning Star is a three-candlestick pattern that appears at the end of a downtrend and signals the beginning of a bullish reversal. It is composed of the following:

- First Candle: A long bearish candle indicating strong selling pressure.

- Second Candle: A small-bodied candle (bullish or bearish) that represents market indecision. This candle typically has gaps and may be a doji.

- Third Candle: A long bullish candle that closes above the midpoint of the first candle, confirming the start of a potential uptrend.

Together, these candles form the Morning Star pattern, which reflects a shift in market sentiment from bearish to bullish.

How to Recognize the Morning Star Pattern

Recognizing the Morning Star pattern requires a keen eye for specific price action elements. Here’s how to spot it:

- Downtrend Presence: The pattern should appear at the end of a downtrend, as it’s a reversal signal.

- First Candle: Look for a long bearish candle that confirms strong selling pressure.

- Second Candle: A small-bodied candle indicating market indecision. This candle may gap down from the first candle’s close, forming the “star” of the pattern.

- Third Candle: A strong bullish candle that closes above the first candle’s midpoint, confirming a potential reversal.

Volume is often used to confirm this pattern; an increase in volume on the third candle suggests more buying interest, supporting the reversal.

Why is the Morning Star Pattern Important?

The Morning Star pattern is essential in forex trading for several reasons:

- Reversal Signal: It helps traders identify a shift from a bearish to a bullish market, indicating an entry opportunity.

- Trend Change Confirmation: The three-candle structure provides confirmation of a trend change, reducing the likelihood of false signals.

- Support and Resistance Levels: Morning Star patterns often align with key support levels, adding strength to the reversal signal.

How to Trade Using the Morning Star Pattern

Trading the Morning Star pattern involves using it as an entry signal for long positions. Here’s a basic approach:

- Wait for Pattern Confirmation: Ensure the pattern is complete with the third bullish candle closing above the midpoint of the first candle.

- Place an Entry Order: After confirmation, consider entering a buy order at the close of the third candle.

- Set a Stop-Loss: Position your stop-loss just below the low of the pattern, limiting potential losses if the trade moves against you.

- Define a Profit Target: Use recent resistance levels or a risk-to-reward ratio of 1:2 or higher to set your profit target.

Example of the Morning Star Pattern

Imagine a forex chart where EUR/USD has been in a downtrend. After a long bearish candle, a small-bodied candle appears, followed by a strong bullish candle. This sequence completes the Morning Star pattern, signaling a potential reversal to an uptrend. If confirmed by volume and other indicators, this pattern can be a strong buy signal.

Limitations of the Morning Star Pattern

While the Morning Star pattern is powerful, it has some limitations:

- False Signals: If volume doesn’t confirm the third candle, it may lead to a false reversal signal.

- Trend Context: This pattern is best used in clear downtrends and can be less effective in sideways or choppy markets.

- Dependency on Volume: The pattern is more reliable when supported by high trading volume, which may not always be present.

Conclusion

The Morning Star candlestick pattern is a valuable tool for forex traders looking to capitalize on market reversals. By understanding its structure, traders can improve their entry timing and leverage this pattern to identify profitable opportunities. With careful confirmation and volume analysis, the Morning Star can be a powerful ally in identifying new uptrends and enhancing trading strategies.