Resistance Strong Support (RSS) is an essential concept in forex trading that occurs when a previous resistance level becomes a strong support level after a price breakout. This phenomenon signals a shift in market sentiment and psychology. Traders utilize this pattern to make better-informed decisions regarding their trades, as it can be a powerful indicator of future price movements.

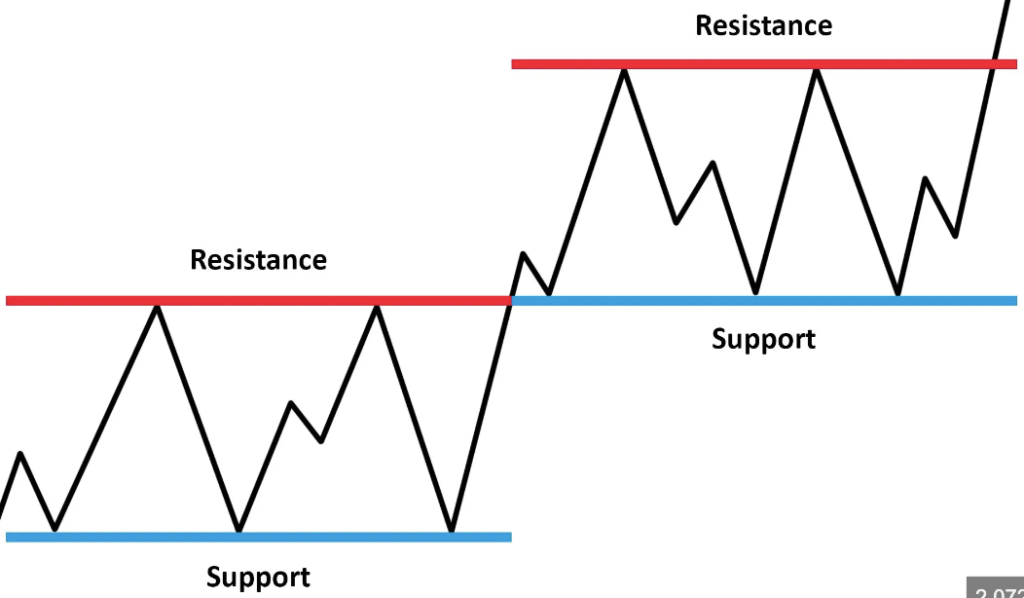

To fully grasp the importance of RSS, we first need to understand how support and resistance levels function. In technical analysis, support refers to a price level where the market tends to halt its decline and might reverse upward. Resistance, on the other hand, is a level where the price tends to face selling pressure and could reverse downward. When the price breaks above a resistance level, that level can later act as strong support, which is the essence of the RSS concept.

The Role of Resistance in Trading

Resistance levels are often used by traders to identify potential sell or short-sell opportunities, as they represent zones where the price struggles to move higher due to increased selling activity. This level forms when sellers prevent buyers from pushing the price beyond a certain threshold. As such, resistance levels become key markers for traders when planning their market entries and exits.

However, when the buying pressure is strong enough to break through resistance, the market dynamic changes. What was once a ceiling (resistance) becomes a floor (support), marking a significant shift in market sentiment. This is where the concept of Resistance Strong Support (RSS) comes into play.

How RSS is Formed

The process of Resistance Strong Support (RSS) typically unfolds in the following steps:

- Initial Resistance Formation: The price reaches a level where it consistently faces selling pressure and is unable to move higher. This forms the resistance level.

- Breakout: As buying pressure increases, the price eventually breaks above the resistance level, signaling a potential upward trend.

- Retest: After the breakout, the price may return to retest the previous resistance level, which now acts as support.

- Confirmation of Strong Support: If the price bounces off this level and moves upward again, it confirms that the previous resistance has now become strong support.

This transition from resistance to support is crucial for traders, as it confirms that the market has shifted from a bearish to a bullish sentiment. Traders often use this as a signal to enter a long (buy) position, anticipating further upward movement in price.

Why RSS is Important for Traders

The concept of Resistance Strong Support is vital because it provides traders with a reliable way to anticipate future price movements. When a former resistance level turns into support, it signifies that buyers are willing to defend this level, making it a potentially safer entry point for long trades. Additionally, understanding RSS helps traders avoid false breakouts, which can lead to unnecessary losses.

Here are some key reasons why traders focus on RSS:

- Improved Trade Entries: Traders often look for RSS patterns to make more accurate entry points into the market. When resistance turns into support, it signals a strong buying opportunity, reducing the risk of a price reversal.

- Minimizing Risk: By waiting for a retest of the resistance level that becomes support, traders can better manage their risk. If the price bounces off this support level, it reduces the likelihood of a false breakout.

- Confirmation of Trend Direction: RSS helps traders confirm that the market trend is shifting in their favor. This confirmation provides them with greater confidence to hold their positions longer.

How to Use RSS in Your Trading Strategy

Incorporating the RSS pattern into your trading strategy can significantly improve your ability to make profitable trades. To effectively use RSS, traders need to keep an eye on the following:

- Price Breakout: Monitor the price closely as it approaches and attempts to break through a resistance level. A clear breakout is the first sign that the RSS pattern may develop.

- Retest of Resistance: After the breakout, watch for the price to return to the previous resistance level. This retest is critical in confirming whether the level has turned into strong support.

- Enter the Trade: Once the retest occurs and the price bounces back upwards, it’s a signal that the resistance has indeed become strong support. This is an opportune time to enter a long position.

- Set Stop-Loss: Place a stop-loss order just below the new support level (former resistance) to protect yourself against potential reversals.

By understanding and applying the RSS concept in your trading strategy, you can increase your chances of entering the market at the right time and improve your overall profitability.

Conclusion

Resistance Strong Support (RSS) is an invaluable tool for forex traders looking to capitalize on trend reversals and breakouts. By mastering this concept, you can make more informed decisions, improve your trade entries, and minimize risk. As you continue developing your trading skills, keep an eye out for RSS patterns to help you identify key opportunities in the forex market.